Individuals

Step 1 – Organise

The first step is about becoming financially well organised.

Together, we discuss the components of your Family Company.

We will help you to find better ways to do things and answer the hard questions.

Debt

Ensure you are not overpaying for your debts

Is your Family Company over or under leveraged?

Are you getting the most out of your home loans?

Tax

Keeping everything under one roof

Look at your current structures and situation to minimise tax

Risk

Protect your family now and in the future

Ensure that another family member can take over as CEO

Retirement Plan

Are you paying too much for super?

Will your super get you there?

What does your super do for you?

Do you want your super to do more?

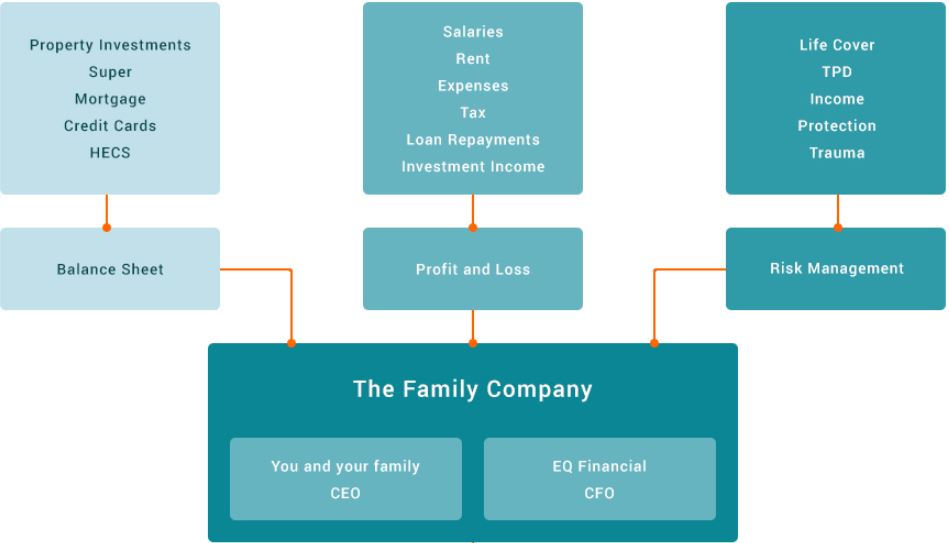

Your "Family Company"

At EQ Financial we believe that your financial well-being is akin to running a company.

The most important part is ensuring that your Family Company runs at its optimum efficiency.

EQ Financial partners with you as your CFO to help streamline your "Family Company" for success

Step 3 - Protect

Putting a plan into place is great, but the best laid plans can be unravelled by sudden and unforseen events.

EQ Financial helps you protect what you have created through using business and asset protection structures.

Your Family Home

Quarantine your home from banks, creditors and litigators, even if you owe money.

Your Bank Account

Bulletproof your bank accounts while increasing your wealth.

Your Property Portfolio

Safeguard your rental income and properties while expanding your portfolio.

Your Income

Shield your wages from garnishees and instalment orders.

Your Superannuation

Safeguard your retirement nest egg from meltdowns and nationalisation.